Commercial General

Liability Insurance

Start Navigating Your Savings Today

Calling this number will direct you

to a licensed insurance agent

Commercial General Liability Insurance from NavSav Insurance

Protect Your Business

Safeguard your business with comprehensive commercial liability insurance coverage. Whether you’re a small business or a large corporation, having the right insurance protection is crucial. At Navsav Insurance, we specialize in providing reliable and tailored commercial liability insurance solutions to meet your specific needs.

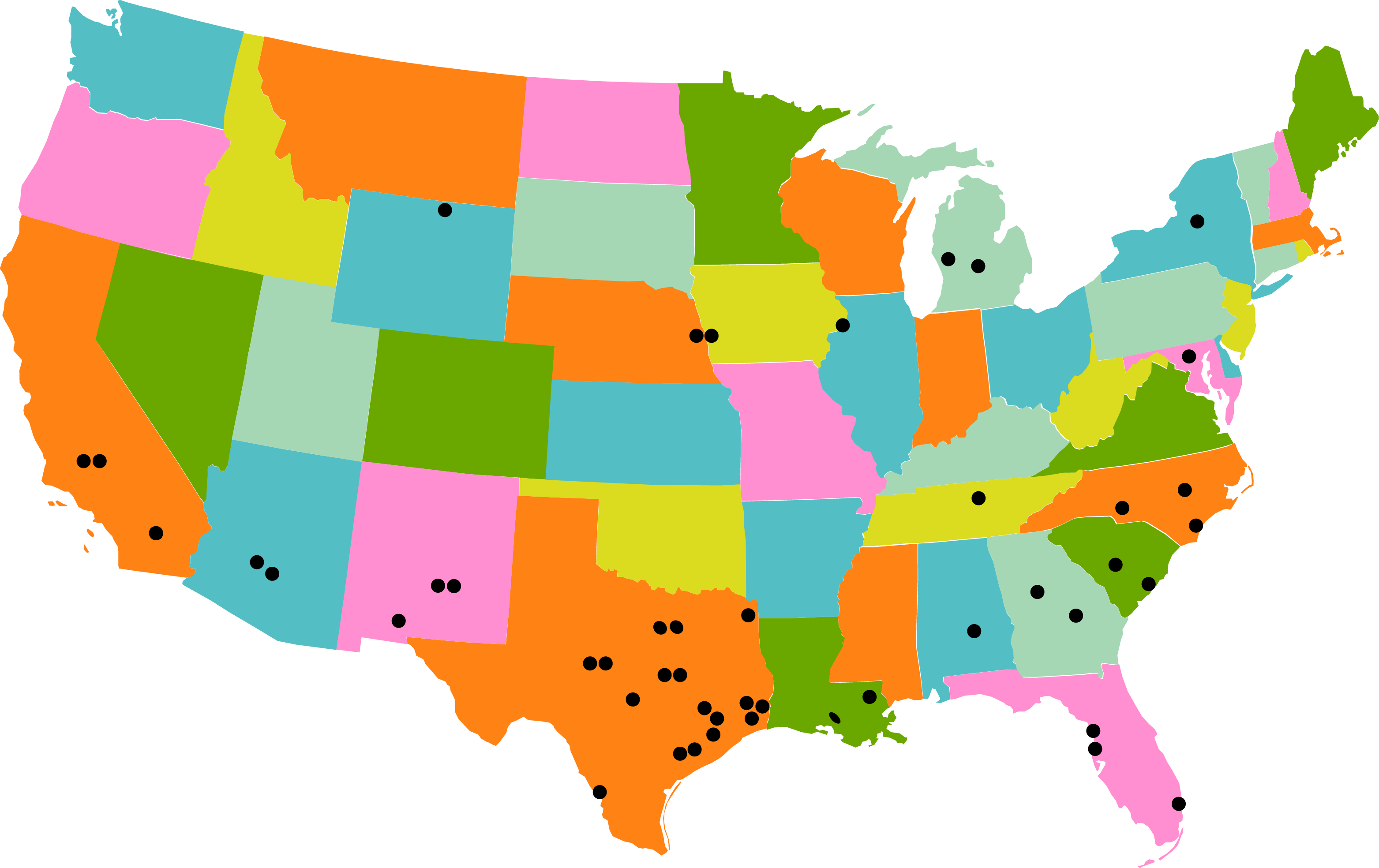

Find An Agency Near Me

Trust Navsav Insurance for Your General Liability

and Workers' Compensation Insurance Needs

What is General Liability Insurance?

General Liability Insurance is a crucial form of coverage that protects businesses from financial losses resulting from claims of property damage, bodily injury, personal injury, and advertising injury.

This insurance safeguards businesses by covering expenses related to accidents, injuries, and damages that may occur on their premises or as a result of their operations, products, or services. It provides coverage for medical expenses, legal fees, and potential settlements or judgments, offering businesses financial security and peace of mind.

With Commercial General Liability Insurance, businesses can focus on their operations knowing they have protection against unexpected liabilities and potential lawsuits.

Our coverages can include:

General Liability Insurance:

Protect your business from claims of property damage or bodily injury that may occur on your premises or as a result of your operations.

Professional Liability Insurance:

Safeguard your business from claims related to errors, negligence, or omissions in the professional services you provide.

Product Liability Insurance:

Ensure your business is protected against claims arising from injuries or damages caused by your products.

Public Liability Insurance:

Cover the costs of legal claims and compensation if a member of the public is injured or their property is damaged due to your business activities.

General Liability Insurance is important for:

Commercial liability insurance is crucial for businesses of all sizes and industries, including small businesses, contractors, retailers, professional service providers, manufacturers, and service-based businesses.

It provides financial protection against claims of property damage, bodily injury, and other liabilities that may arise during business operations.

Protect your business and mitigate potential risks by obtaining the right commercial liability insurance coverage.

With our commercial liability insurance, you can have peace of mind knowing that your business is protected against unexpected expenses and potential lawsuits.

What is General Liability Insurance?

General Liability Insurance is a crucial form of coverage that protects businesses from financial losses resulting from claims of property damage, bodily injury, personal injury, and advertising injury.

This insurance safeguards businesses by covering expenses related to accidents, injuries, and damages that may occur on their premises or as a result of their operations, products, or services. It provides coverage for medical expenses, legal fees, and potential settlements or judgments, offering businesses financial security and peace of mind.

With Commercial General Liability Insurance, businesses can focus on their operations knowing they have protection against unexpected liabilities and potential lawsuits.

Our coverages can include:

General Liability Insurance:

Protect your business from claims of property damage or bodily injury that may occur on your premises or as a result of your operations.

Professional Liability Insurance:

Safeguard your business from claims related to errors, negligence, or omissions in the professional services you provide.

Product Liability Insurance:

Ensure your business is protected against claims arising from injuries or damages caused by your products.

Public Liability Insurance:

Cover the costs of legal claims and compensation if a member of the public is injured or their property is damaged due to your business activities.

General Liability Insurance is important for:

Commercial liability insurance is crucial for businesses of all sizes and industries,

including small businesses, contractors, retailers, professional service providers, manufacturers, and service-based businesses.

It provides financial protection against claims of property damage, bodily injury, and other liabilities that may arise during business operations.

Protect your business and mitigate potential risks by obtaining the right commercial liability insurance coverage.

With our commercial liability insurance, you can have peace of mind knowing that your business is protected against unexpected expenses and potential lawsuits.

Get a Free Quote Today

Don’t wait to protect your vehicle and your wallet. Get a free quote today and see how much you could save on affordable and comprehensive auto insurance with discounts from Navsav Insurance

An insurance policy is often the only thing keeping you from financial ruin when the inevitable takes place. As such, your indemnity plan should be something that covers all of your assets. The agents at NavSav Insurance can help you find the insurance policies that fit your lifestyle. Our agents can help you find the best insurance plan to fit your needs. You may also consider bundling protections into one policy for even more convenience.

Choose from NavSav’s other products Or, get an Instant Quote

Natural Disaster

Renters

Business

Looking for an Agent? Find an insurance agent near me.

Did You know we also Can provide Commercial Property Insurance?

We make it easy for our customers to compare quotes from different companies so they can get the best possible rate on their auto insurance policies. Our online quoting system allows customers to easily enter their information once and get multiple quotes in minutes.

Looking for an Agent? Find an insurance agent near me.