Employee Health Coverage

Enhancing Your Coverage and Confidence

Calling this number will direct you

to a licensed insurance agent

Calling this number will direct you

to a licensed insurance agent

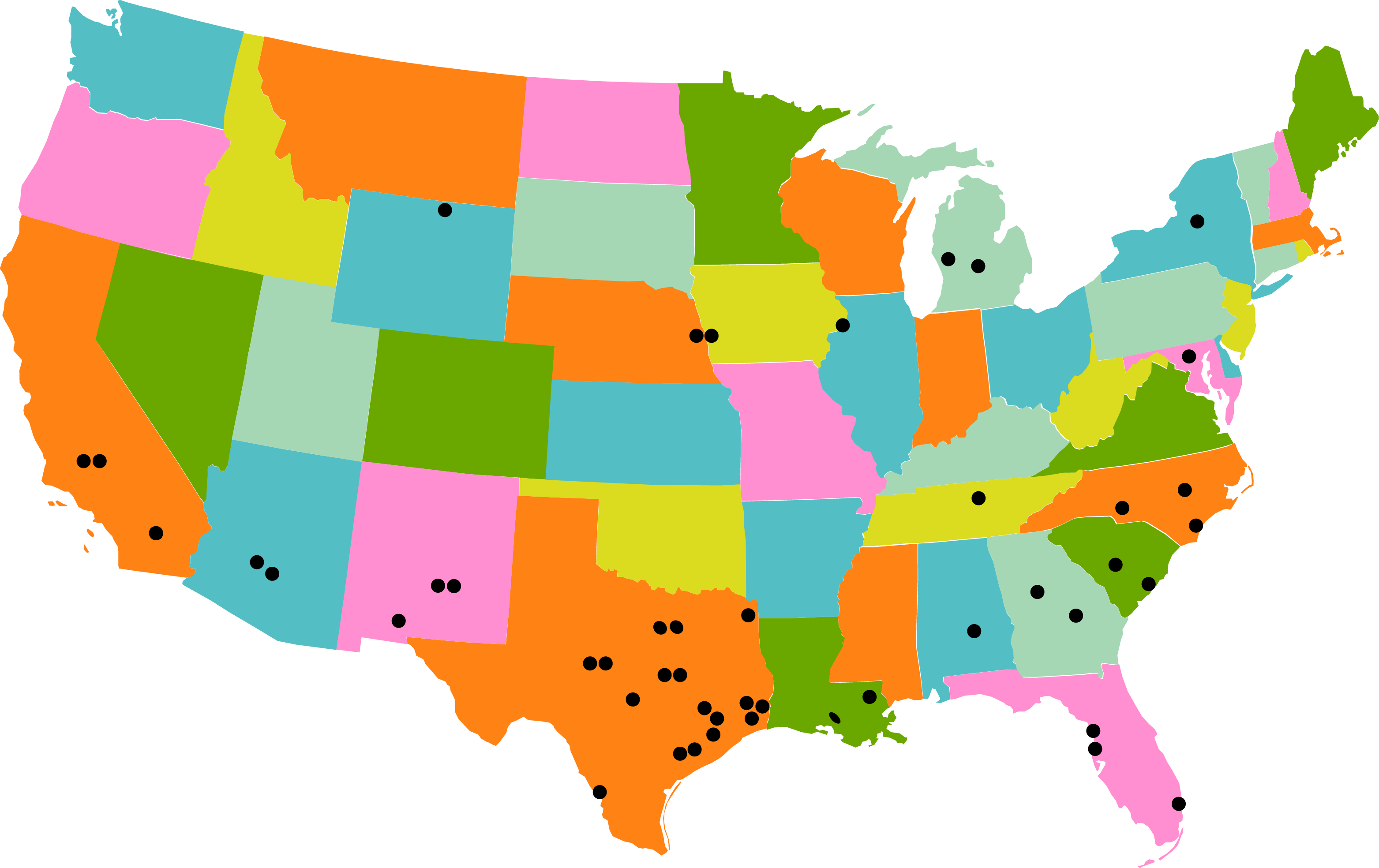

NavSav uses its network of locations to access national and regional medical carriers.

Our expertise will help negotiate the best plan designs and renewal options. In addition to designing traditional health plans, we have many options for alternative funding that provide savings opportunities while maintaining quality coverage for your employees.

Find An Agency Near Me

Health Plans / Employee Benefits

Unlike other insurance products and markets, health care brokers get access to the same plans and rates.

Unlike other insurance products and markets, health care brokers get access to the same plans and rates. When choosing which broker to work with, you want to consider the resources their agency can provide and the strategies they can help design. We at NavSav are committed to finding the best options for our groups and continuously stay abreast of emerging market trends. In addition to designing the right plan and contribution strategy, we offer HR support, technology consultation, exclusive ancillary benefit programs, and compliance expertise.

Carriers we work with

- Blues Cross Blue Shield

- United Healthcare

- Cigna

- Aetna

- Gravie

- Kaiser

- Medica

- Allstate

- Surest

- Principal

- Colonial

- Lincoln Financial Group

- MetLife

- Delta Dental

- Mutual of Omaha

- Unum

- Guardian

- VSP

- Sun Life

- NY Life

- Humana

- The Standard

- Ameritas

- Hartford

Ancillary Plans

Dental

There is a strong link between oral health and overall medical health. Many work hours and even days are lost each year to workers with dental problems. By offering a custom design dental benefit plan can lead to a better overall healthy employee population and reduce the cost of your medical claims.

Vision

Healthy vision is an important part of your overall wellness. Clear vision is just the beginning as a routine eye exam can also uncover serious health concerns. We will work with you to customize a vision plan that is right for your employee population.

Life & AD&D

This is a common employer sponsored life insurance offering. The advantage of offering to your employees is that it is generally very affordable benefit because the spread of risk is amongst the entire company employee population. You also get to take advantage of the ability to have Guarantee Issue amounts that do not require proof of good health. These benefits can increase employee’s appreciation of their overall benefits package.

Short Term and Long Term Disability

The risk of disability is greater than most employers and employees realize. When becoming disabled and unable to work employees lose their source of income with an increase in medical expenses. Offering a disability benefit to your employees will provide them with income protection and lessen the burden of the employee’s expenses. Let us help you become an employer of choice with a custom disability benefit package that works for your benefit strategy and retention needs.

Voluntary Plans

Offering Voluntary Benefits

Voluntary benefits are designed to help with costs not covered by traditional medical insurance. These benefits help pay for things like medical bills, household expenses, and lost wages. Employees like them because the money goes straight to them to use where they need it.

The great thing about voluntary benefits is that they can be customized for different businesses and their workers. You can choose what works best for your employees, whether it’s fully paid by them or a mix of their and your contributions.

Different Types of Voluntary Benefits

A diverse array of voluntary benefits awaits consideration for your employees, spanning health, wellness, and financial security categories. Each product is designed to address specific needs that your workforce may encounter.

• Short Term Disability

• Long Term Disability

• Life and AD&D

• Critical Illness

• Hospital Indemnity

• Cancer Insurance

• Accident

• Dental

• Vision

An insurance policy is often the only thing keeping you from financial ruin when the inevitable takes place. As such, your indemnity plan should be something that covers all of your assets. The agents at NavSav Insurance can help you find the insurance policies that fit your lifestyle. Our agents can help you find the best insurance plan to fit your needs. You may also consider bundling protections into one policy for even more convenience.

Choose from NavSav’s other products Or, get an Instant Quote

Natural Disaster

Renters

Business

Looking for an Agent? Find an insurance agent near me.