Health Saving Accounts

Navigating Healthcare Finances with Confidence

Calling this number will direct you

to a licensed insurance agent

What is a Health Saving Account (HSA)?

Health Savings Account (HSA) Plans are a unique and flexible way to manage your medical costs. An HSA is a tax-advantaged savings account that allows you to set aside funds specifically for qualified medical expenses. From doctor visits and prescriptions to dental and vision care, HSAs cover a wide range of healthcare needs. What sets HSAs apart is their triple tax advantage: your contributions are tax-deductible, the funds grow tax-free, and withdrawals for qualified medical expenses are also tax-free.

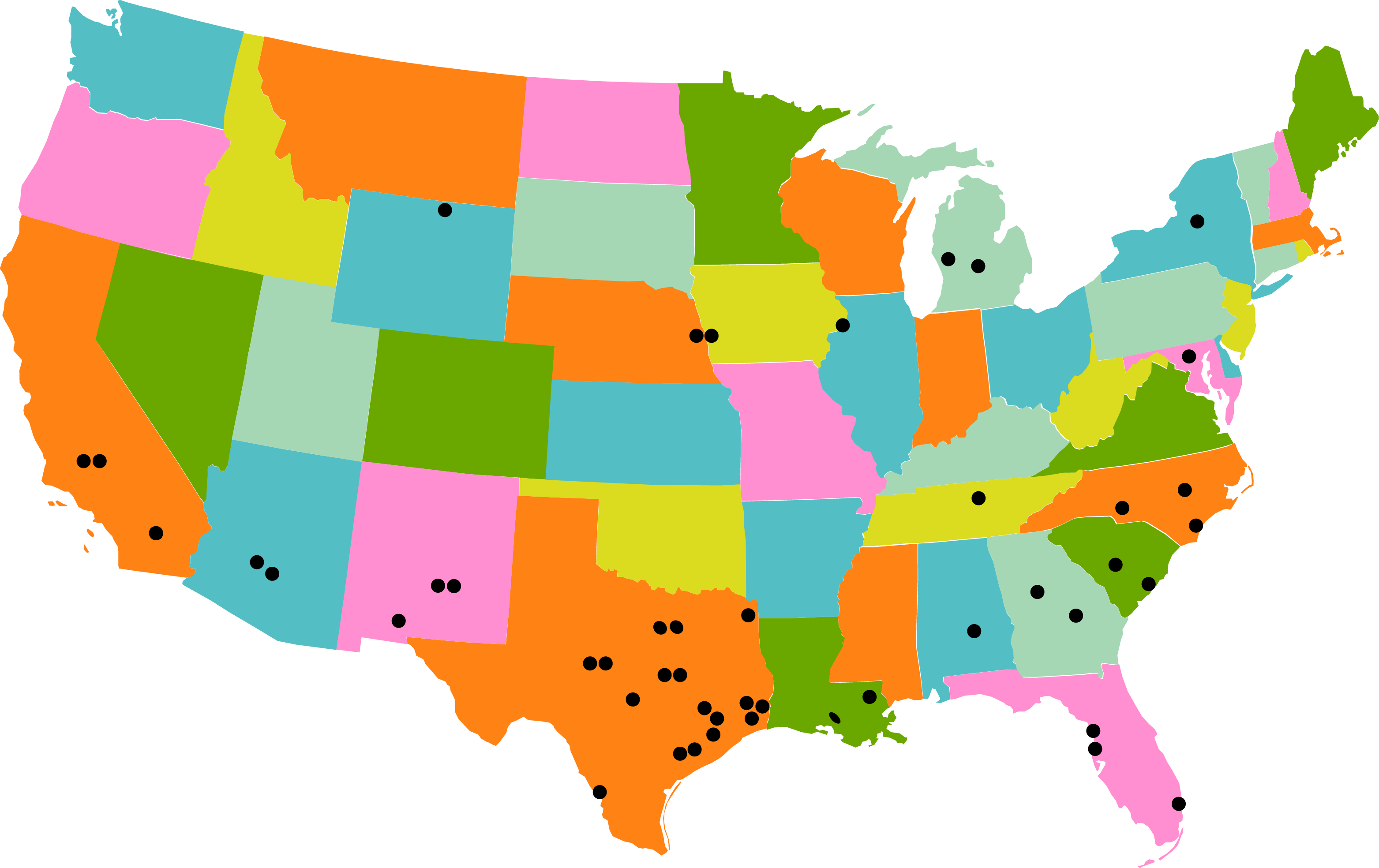

Find An Agency Near Me

Why is important to have a Health Savings Account?

Empowerment: With an HSA, you have the power to determine how much you contribute, giving you the ability to budget for future medical expenses and even save for retirement healthcare costs.

Tax Benefits: HSAs offer significant tax advantages. Your contributions reduce your taxable income, and qualified withdrawals are entirely tax-free, making it a smart financial strategy.

Portability: Your HSA remains yours, whether you change jobs or retire. It’s a consistent way to manage your healthcare expenses, no matter where life takes you.

Flexibility: You decide how to utilize your HSA funds – whether for immediate medical needs or for long-term healthcare planning.

How HSA Plans Work:

A Simple Guide

Enroll: When you choose a health insurance plan that’s HSA-eligible, you can open an HSA. You’ll contribute to the account and use those funds for qualified medical expenses.

Contribute: Contributions can be made through pre-tax payroll deductions or on your own. Your contributions accumulate and can even be invested, helping your funds grow over time.

Use: Whenever you have a qualified medical expense, you can utilize your HSA funds to cover it. It’s as straightforward as using a debit card or reimbursing yourself.

Save: If you don’t use all your HSA funds in a year, they roll over to the next year, allowing you to build savings for future healthcare needs.

Explore the Benefits with NavSav Insurance

At NavSav Insurance, we’re dedicated to helping you understand the potential of HSA Plans and Accounts. Our knowledgeable experts are here to guide you, ensuring you make informed decisions that align with your financial goals and healthcare needs. Whether you’re new to HSAs or looking to optimize the benefits of your existing account, we’re here to assist you every step of the way.

Contact us today to discover how HSA Plans and Accounts can revolutionize the way you approach healthcare expenses, offering you greater financial control and a healthier future.

An insurance policy is often the only thing keeping you from financial ruin when the inevitable takes place. As such, your indemnity plan should be something that covers all of your assets. The agents at NavSav Insurance can help you find the insurance policies that fit your lifestyle. Our agents can help you find the best insurance plan to fit your needs. You may also consider bundling protections into one policy for even more convenience.

We would like to help you.

Speak to us about your Health Insurance requirements

Our experienced team is here to guide you and provide the information you need.

Contact us now to take the first step towards a secure tomorrow.

Choose from NavSav’s other products Or, get an Instant Quote

Natural Disaster

Renters

Business

Looking for an Agent? Find an insurance agent near me.