Alternative Funding Strategies

Optimize Your Benefits

Calling this number will direct you

to a licensed insurance agent.

Calling this number will direct you

to a licensed insurance agent.

Alternative Funding Strategies refer to any insurance strategy that is not fully insured by a national carrier.

Alternative Funding Strategies refer to any insurance strategy that is not fully insured by a national carrier. These solutions can layer on top of a traditional plan or operate in a very unique way. We can all admit there is one thing for sure when it comes to health insurance, it is expensive and is only getting more expensive. By utilizing alternative funding strategies, we help employers take back control of the healthcare spend and provide sustainable, affordable, efficient, healthcare for their employees.

Find An Agency Near Me

Funding Options

Non Traditional Solutions

- Minimum Essential Coverage

- Self-Insured Lite with an HRA

- ICHRA

- Spousal Carve Outs

- Directed Network Solutions

- Behavior Based Contribution Strategy

- Class Structure

- Reference Based Pricing

- Accountable Care Programs

- Direct Primary Care

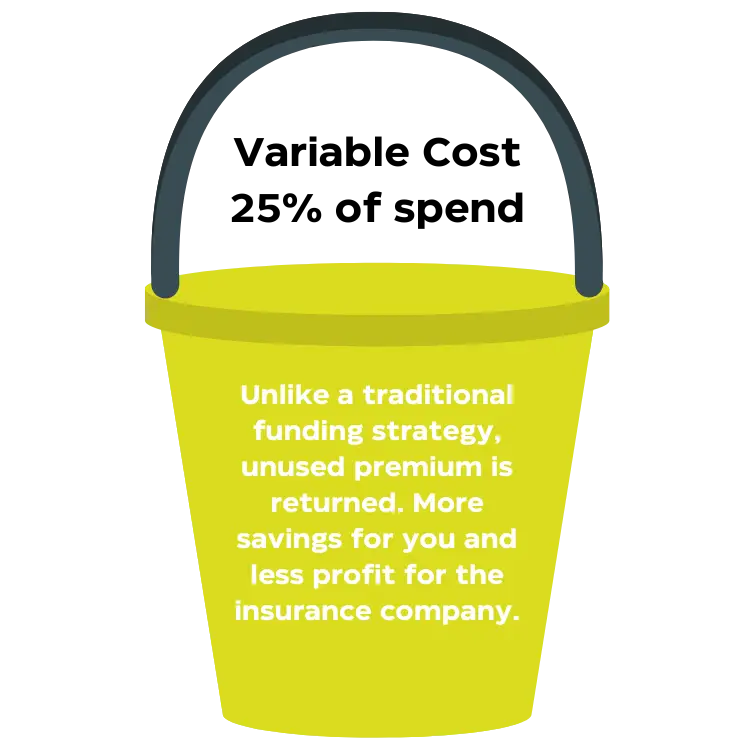

Level Funded

Group with less than 50 employees can partner with a level funded solution to offer a composite rate for their employees, rather than having to forecast cost through an age – banded solution.

Level Funded solutions are designed for employers between 2-150 employees. While this is technically a form of self-funding, it operates like a fully insured plan with an annual dividend based on performance. This is a great solution for groups under 50 or healthy groups over 50.

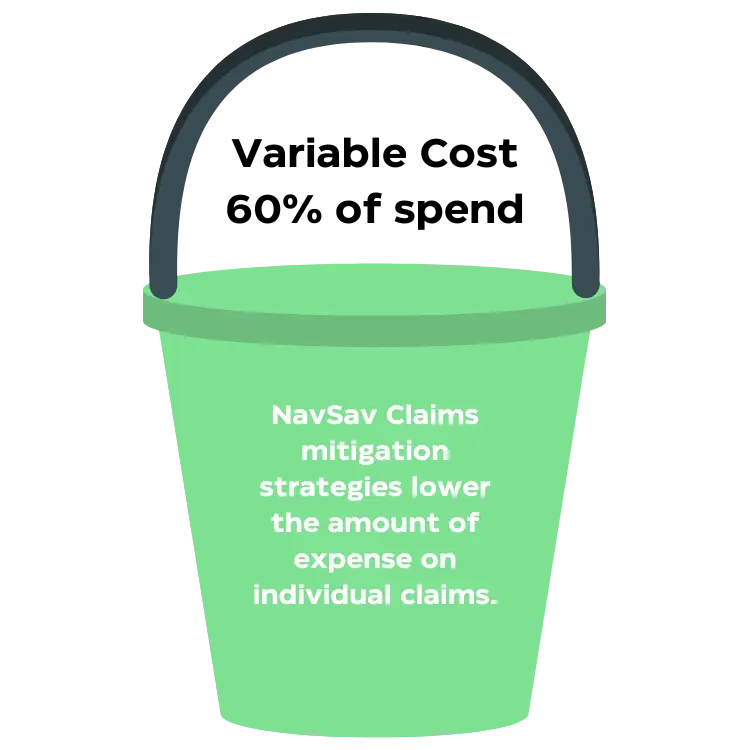

Self-Funded

While there are many ways to structure a self funded plan, the basic components all remain the same. This strategy is designed for calculated risk with high reward. Instead of paying an insurance company to provide services and keep all of the profits, you can design your own plan and only pay for the coverage used.

Navigate your Self-Funded Savings

- TPA Selection – who will process your claims

- Pharmacy Benefit Manager – return of expense via rebates from the pharmacy manufacturer.

- Network Discount and Performance

- Stop Loss Contract – Understand the difference in contract language

- Specific Deductible Benchmarking

- No New Laser Contracts

- Guaranteed rate caps

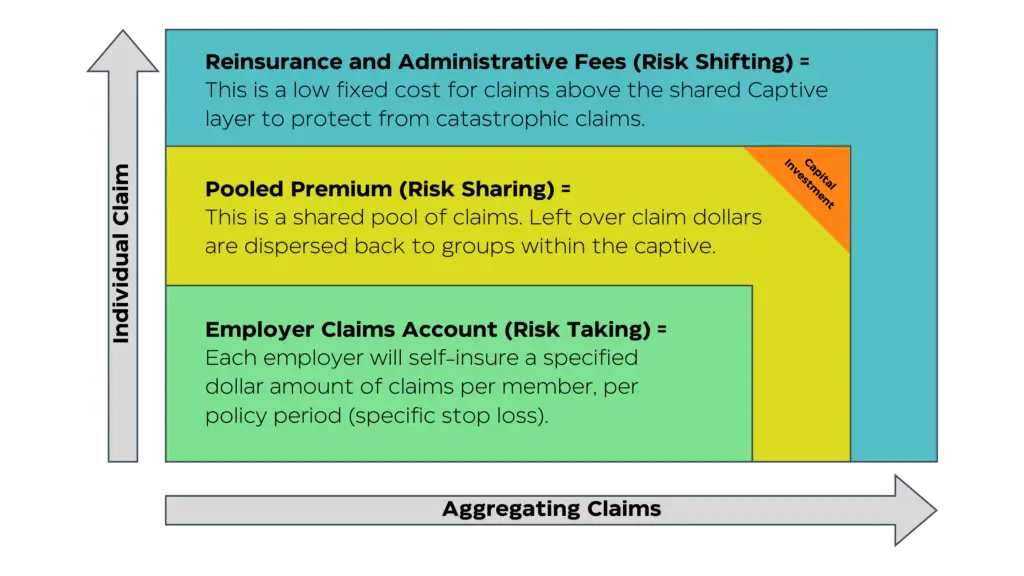

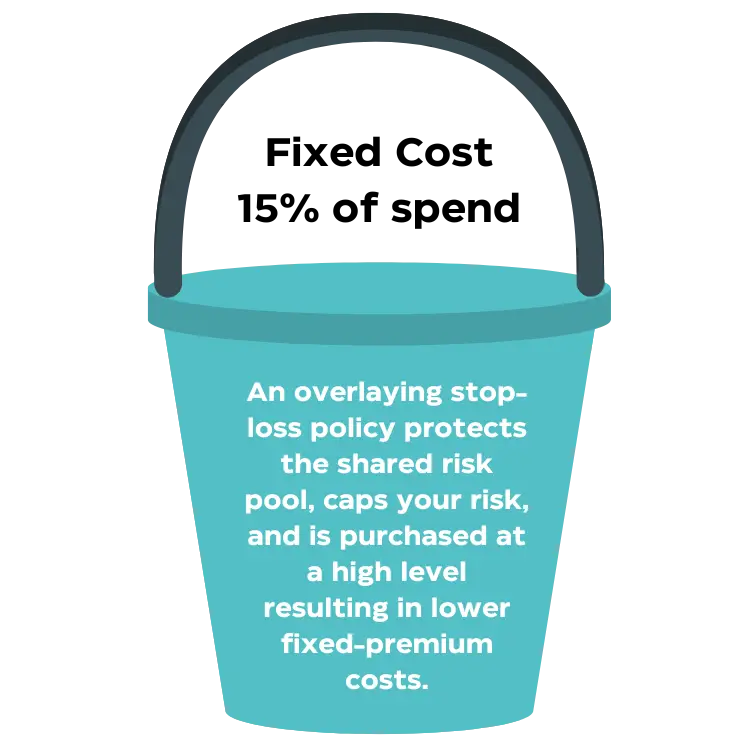

Captive Solutions

Captive solutions allow you to share risk with other like-minded companies. Often this solution will provide tax incentives, return of premium, and a dividend payment. While captives in general are a great solution, not all captives are created equal. Allow us to Navigate the details of your captive options to select the best it for your individual goals.

An insurance policy is often the only thing keeping you from financial ruin when the inevitable takes place. As such, your indemnity plan should be something that covers all of your assets. The agents at NavSav Insurance can help you find the insurance policies that fit your lifestyle. Our agents can help you find the best insurance plan to fit your needs. You may also consider bundling protections into one policy for even more convenience.

Choose from NavSav’s other products Or, get an Instant Quote

Natural Disaster

Renters

Business

Looking for an Agent? Find an insurance agent near me.